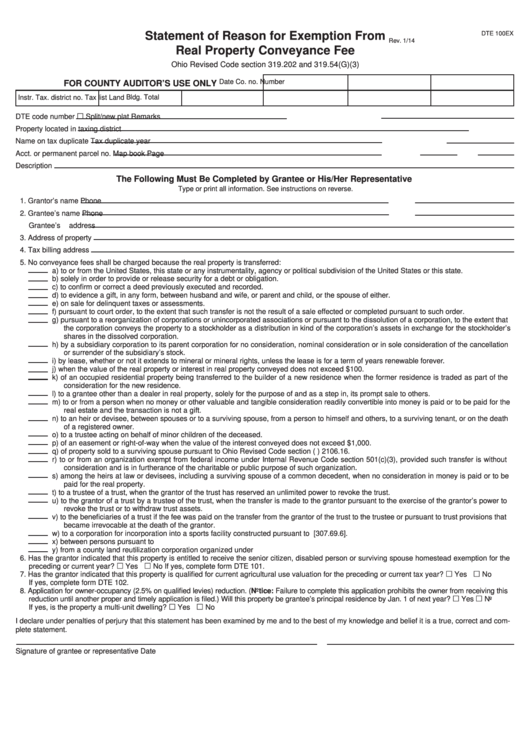

The consideration and tax fields now display commas.If an exemption is claimed, the preparer can enter the consideration on the appropriate line and there is "no tax due" calculation.

Exempt codes 1, 9A, 9B, 9C or 9D require a citation as well.

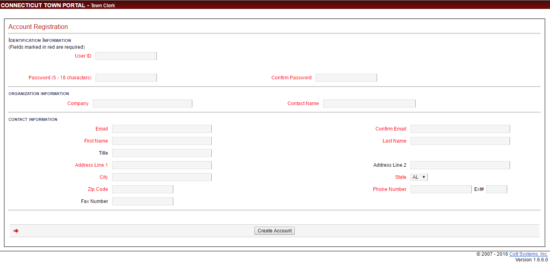

EXEMPTION CODES ARE GIVEN ON REVERSE SIDE OF FORM OP-236.ĭRS Update: Connecticut Real Estate Conveyance Tax Return Information TAX CALCULATION INSTRUCTIONS ARE GIVEN ON FORM OP-236.įOR CONVEYANCES THAT ARE STATUTORILY EXEMPT OR ARE FOR NO CONSIDERATION, STATE FORM OP-236 MUST STILL BE COMPLETED AND SUBMITTED, INDICATING REASON FOR EXEMPTION. THIS FORM MUST BE ACCOMPANIED BY:Ī CHECK FOR STATE CONVEYANCE TAXES, MADE PAYABLE TO THE COMMISSIONER OF REVENUE SERVICES Ī SEPARATE CHECK FOR LOCAL CONVEYANCE TAXES, MADE PAYABLE TO THE Columbia Town Clerk. Recording Nominee (Mers) $ 159.00 plus $5.00 each additional pageĪ $2.00 LOCAL CONVEYANCE FEE IS DUE FOR ALL REAL ESTATE TRANSFERS IF ANY CONSIDERATION WAS PAID.įOR CONVEYANCES WITH CONSIDERATION OF $2,000 OR MORE: YOU MUST SUBMIT A COMPLETED (ORIGINAL) STATE OF CONNECTICUT REAL ESTATE CONVEYANCE TAX RETURN (OP-236).

CT REAL ESTATE CONVEYANCE TAX FORM HOW TO

See How To Fill Out The Connecticut Real Estate Conveyance Tax Return - Connecticut Online And Print It Out For Free.

CT REAL ESTATE CONVEYANCE TAX FORM PDF

Recording Nominee (Mers) $159.00 flat fee Download Form Op-236 Instructions Connecticut Real Estate Conveyance Tax Return - Connecticut In Pdf - The Latest Version Of The Instructions Is Applicable For 2022.

0 kommentar(er)

0 kommentar(er)